“Empowering visionaries, curating growth, and embracing risks that’s where we ignite innovation and shape the future!“

As a dynamic team of two individuals, Mr. Suvas Barot and Mrs. Anju Barot, we bring expertise from different fields, allowing us to complement each other’s viewpoints effectively. In the world of investments, we understand that emotions often play a significant role in decision-making, leading to choices based on likes and dislikes rather than solid facts, figures, and performance metrics. However, we strive to maintain a balanced approach by carefully considering the history and characteristics of the individuals behind the projects and ideas we plan to invest in.

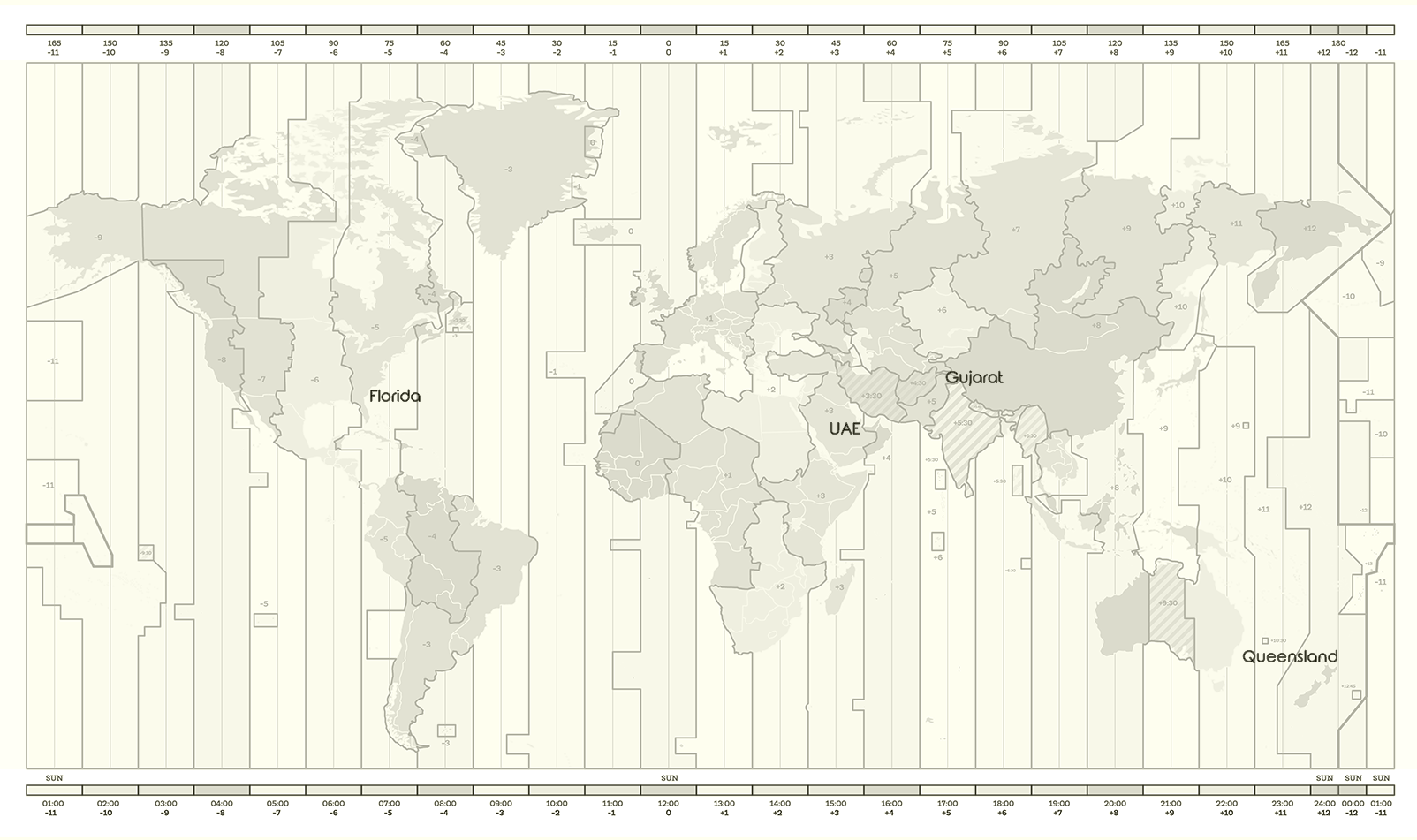

Due diligence is a core principle of our firm and we go to great lengths to thoroughly evaluate each project’s product, usability, market potential, and demographics. Our investment philosophy is rooted in the teachings of our ancestors, who believed in making money work for us even when we sleep. With the advancement of technology and communication, we have embraced real-time decision-making and increased our productivity ensuring we can capitalize on opportunities across different time zones.

Mrs. Anju Barot and Mr. Suvas Barot have a brief history of successful asset-class investments,

Which include diverse portfolios in:

Unlock Wealth Opportunities: Explore real estate investment at Plus13

Diverse Portfolio: From upscale homes to prime retail spaces, discover residential and commercial options.

Capital Gains Potential: Leverage property value appreciation for substantial returns.

Steady Rental Income: Generate consistent revenue through strategic real estate investments.

Prosperity Awaits: Join us in building wealth through informed and strategic investment choices.

At Plus13, we embody the principles of surplus and addition, constantly seeking growth in numbers, profits, and resources. Mr. Suvas Barot and Mrs. Anju Barot, a dynamic team of experts, welcome you to their investment company. They curate a comprehensive portfolio using a balanced, knowledge-based strategy. Their careful techniques capitalize on chances with confidence, resulting in a noteworthy ROI and IRR.

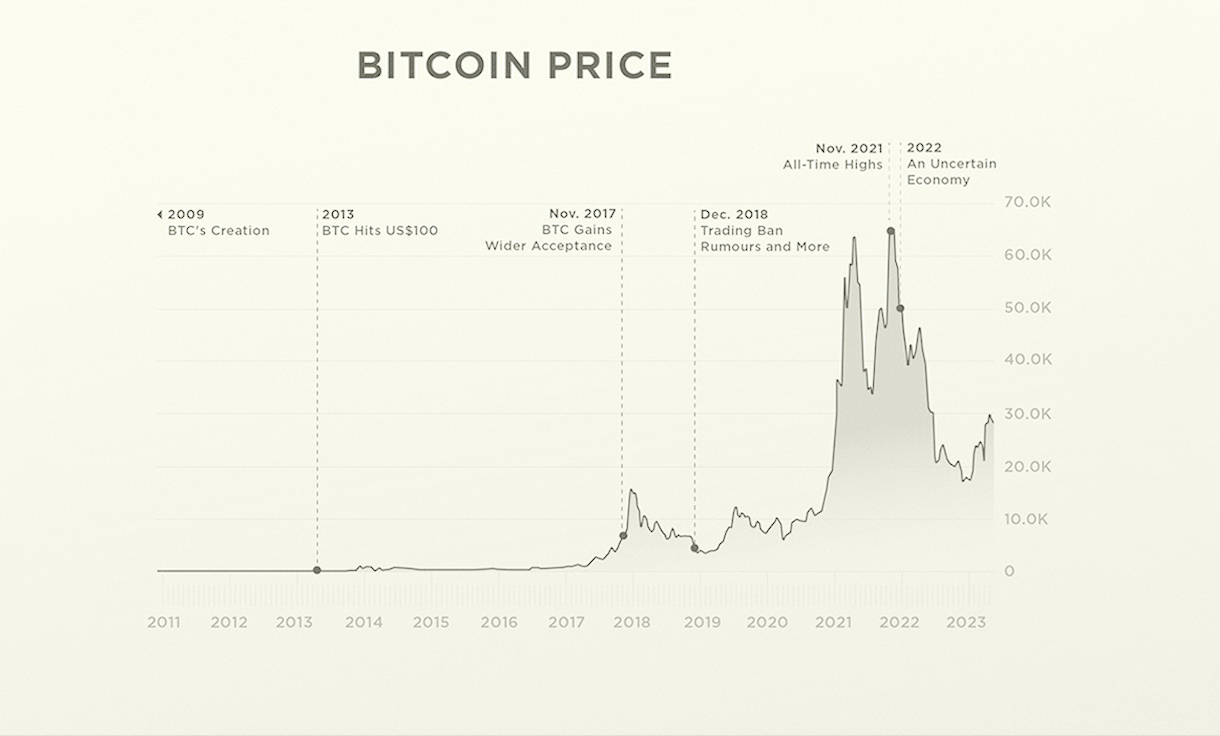

Asset classes traditionally were equities, real estate, and commodities. However, the future holds the emergence of new asset classes and hybrid instruments, offering financial space and diverse opportunities to grow their wealth.

With the advent of the Mid-Digital Era, characterized by rapid technological advancements and evolving financial models, a range of opportunities emerges, offering robust solutions to diversify a portfolio and enhance its resilience. This era necessitates a proactive approach to portfolio management, one that acknowledges the shifting landscape and strategically incorporates emerging trends.

Plus13 encourages a long-term perspective, empowering you to make informed decisions and stay ahead of emerging trends. It also encourages envisioning the potential impact of emerging trends, technological advancements, and global developments on investment opportunities.

Expert Growth Strategies: Leveraging market research, trend analysis, and industry insights, we design customized plans to maximize ROI and propel business expansion. Achieving amiable returns with comprehensive actions and driving sustainable growth for enterprise is what we do.

For me, my space matters the most, and very few people will understand it; Mr. Suvas is one of them who understand it intutively.

It’s not only about capital when it comes to plus 13. It is finance. An entire package to be elaborative. I really admire the way Suvas discusses complex topics and problems in the most basic way with relatable examples.

Their strategic insights and backing helped us expand, refine operations, and create an unforgettable dining experience.

Their investment and marketing expertise helped us build a loyal customer base and expand rapidly.

We got a growth partner. Plus 13's expertise in scaling businesses helped us streamline operations.

Plus 13 provided us with capital, industry connections, and invaluable mentorship to accelerate our growth.

In recent news, Andrew Bailey, The governor of The Bank of England has hinted that interest rates may stay high for longer than expected amid stubbornly high inflation. According to the different sources I follow, Financial arkets expect the Bank to raise rates to 6.25% by the end of this year, which by the resources is claimed to be the highest since 1999.

We want to take a moment to clarify our investment practices and address any concerns that have been raised regarding our investments in certain projects. Plus13 is a privately held investment firm that uses our own funds to invest in a variety of projects across different industries. We are passionate about generating new ideas and supporting startups to help improve society.

When it comes to investing, we conduct thorough due diligence before making any decisions. We either invest in or partner with firms that meet our criteria and align with our values. If you have any concerns about any of our investments, we encourage you to reach out to us through the direct message platform of Plus13.

It's important to note that we only invest in businesses that are approved by the laws of the countries we operate in. We are committed to following all legal requirements and procedures in each jurisdiction. We do not support or engage in any scams or fraudulent activities.

We kindly request that if you have any allegations or information about our partners, please ensure that your profile is authenticated and provide us with proper contact details, such as an active email address and phone number. This will allow us to evaluate the information and, if necessary, have our legal team reach out to you for further details. Without proper identification and substantial proof, information will be considered a rumor, as we cannot fight ghosts.

We appreciate the role that platforms like this play in protecting individuals from scams and fraud. However, it is crucial that the information provided is authenticated and the party providing it is willing to meet with our team when requested. We must work together, as authenticated and interested parties, to combat fraud and scams.

Please remember that our social media platform is intended to motivate individuals to invest wisely and grow their wealth over time. We do not provide investment advice or ask individuals to invest according to our guidelines. It is essential for everyone to conduct their own due diligence before making any investment decisions.

Let's continue to invest and create a safe environment for new businesses and startups to thrive. Let's differentiate between legitimate profit and loss and scams and fraud. And most importantly, let's always do our due diligence.

Thank you for your understanding and support.